"In 1900, life expectancy for much of the industrialized world was under 50. Today, living well into one's 70s, 80s and beyond can be expected." Read more here

The year is 1900: imagine you're 47 or 48 years old and you have less than 12 months to live. In this scenario you had children before you turned 20, and you may get to see the oldest turn 30. Your eldest son or daughter might have a 10 year old child before your time is up, and so with luck (and limited medical science), you'll spend a decade with a grandchild.

That's not such a bad life. 50 good years.

Now you have 78.7 years (in the USA).

Your first child arrives when you're 31 (29 for a woman). If you live until 79 then your child will be 48 and your grandchild 17 when you pass on.

The future: in the USA, by 2034, people aged 65 and up will outnumber those 18 and under for the first time in U.S. history.

We are increasingly living in a world where people live longer and longer.

"Evidence-based studies indicate that longevity is based on two major factors, genetics and lifestyle choices.

Twin studies have estimated that approximately 20-30% of an individual's lifespan is related to genetics, the rest is due to individual behaviors and environmental factors which can be modified."

If it's true that only 20-30% of this 30 year life extension bonus is due to genetics, then we can thank environmental factors such as sanitation and hygiene, as well as an improved diet.

But sometimes the story is more nuanced, as when an advance in age allows one to better regulate emotions, thereby causing more pleasant feelings on a day to day basis.

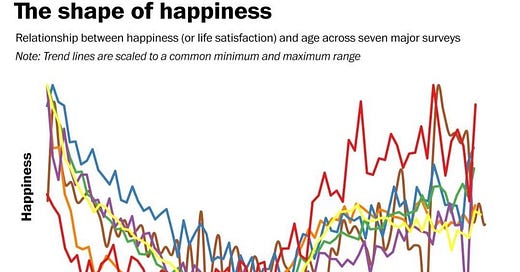

Notice the U-shaped curve in the above graph. Childhood and old age are the best!

With an extra three decades at our disposal, many of which will increasingly be happier than in our crazed youth, doesn't it make sense to prepare well?

This financial calculator might be of assistance (although it's oriented towards first-world costs of living). To its credit the calculator checks 1,000 scenarios (very quickly!) and then gives you a score.

A note: the financial results change radically the more annual expenses you have.

Focusing on minimizing your expenses or at least tracking them carefully is your best bet. Imagine getting a true grasp of what $ leaves your pocket, gets automatically charged to your credit card each month, or is swiped or activated without much hesitation. You owe it to yourself to come to terms with your financial comings and goings so that you feel in control.

Without stressing, if you just track each daily expense you will gain a deeper understanding of what is essential and what isn't.

It may seem like a hassle to click, click, click in order to input each cash transaction into a finance app for example, but getting summaries at the end of each month will allow you to compare your actual expenses to your spreadsheet’s guesstimate that you're currently using (or will be once you take planning seriously).

The bottom line is you'll be older and emotionally happier than at any time throughout the history of humankind.

With some planning you can better enjoy almost 11,000 extra days!

Cheers!

Neill