We all want both clarity and certainty when it comes to our financial future. And as the video below points out, we also want to know whether or not we will have enough money until we die.

According to the cartoonist Scott Adams, who wrote, "How to Fail at Almost Everything and Still Win Big," setting goals doesn't work as well as creating an effective system:

"One should have a system instead of a goal. The system-versus-goals model can be applied to most human endeavors. In the world of dieting, losing twenty pounds is a goal, but eating right is a system. In the exercise realm, running a marathon in under four hours is a goal, but exercising daily is a system."

In light of the above sentiment, rather than creating a goal such as, “I want to retire to Bali in 2 years,” you can create a system that gets you to Bali. How? By taking small step-by-step actions that ultimately “free you up” financially, materialistically, and psychologically too. And the system (with you in the middle of it) feels better because the actions spring from your tweaked habits and new intentions, rather than arbitrarily creating a potentially unattainable goal.

Video: The Secret Early Retirees Know (and you don’t?)

The above video deals with two theoretical couples and how they react to a financial planning simulation called the Monte Carlo simulation. They both have the same financial conditions but they react differently when seeing their simulation numbers. The Monte Carlo simulation creates a huge amount of financial projections (as a range of possibilities on a chart, as well as a single success rate %).

After the video try taking the Monte Carlo simulation below in order to get a sense of how long your money will last.

After running the simulation for yourself, where do you stand? Do the projections give you confidence that you’ll have enough money? In the above video the presenter, Azul, asks whether getting from 80% to 90% certainty is worth another 7 years of work. Now is a good time to ask yourself, “Where do you stand with regard to financial certainty?” Proper reflection and subsequent planning – creating a step-by-step daily system, not a goal – will help you make retirement decisions that you can live with comfortably.

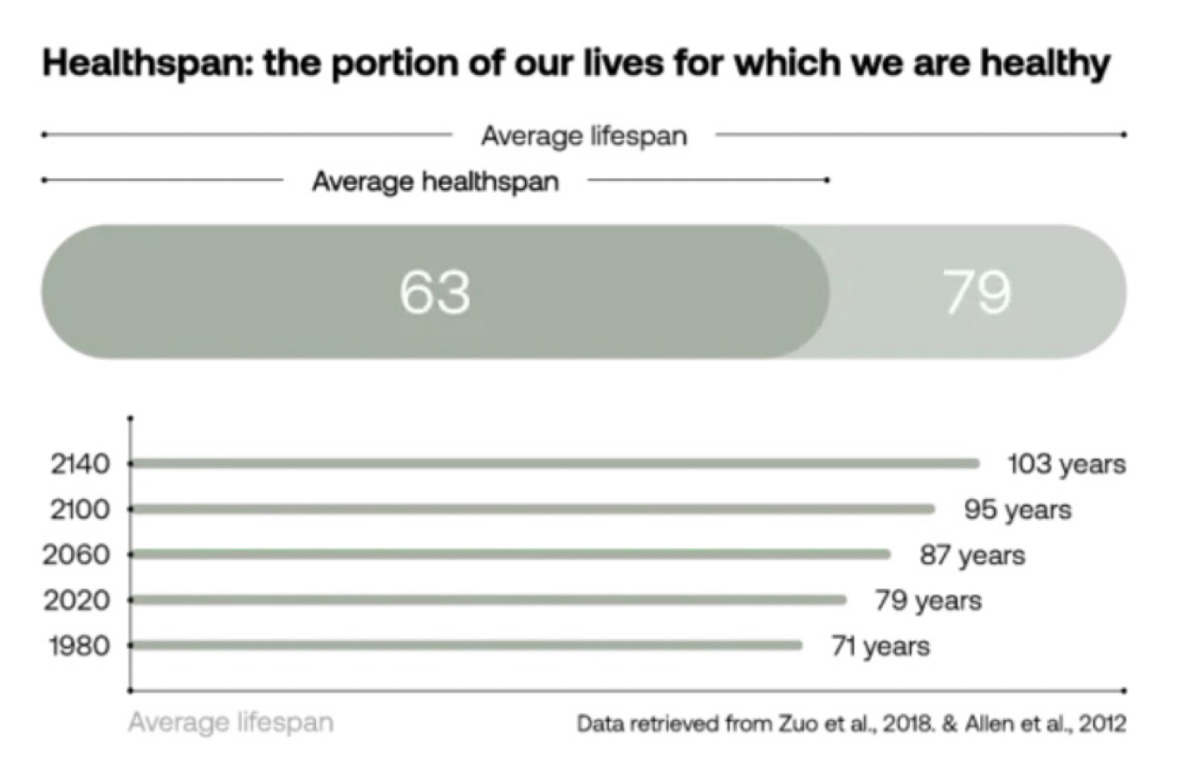

When considering your level of comfort with your financial future (regardless of whether you’ll have 49% or 99% of what you need), consider your “healthspan” for the moment. Healthspan is the term for the healthiest portion of your life, which statistically ends at 63 years old. After that you get another 16 years (again statistically), without your body’s natural health optimization that you’ve had in the past.

For example, if you fall it may take 3 weeks to recover, rather than 3 days. Your aches and pains that quickly left your mind (and body) in those early years are becoming more and more regular and are now something you’ll be dealing with daily. Sleep is not as smooth nor as enjoyable as it once was. Perhaps you forget a few things that you shouldn’t, if in fact you can be aware enough that you’ve forgotten them at all.

The point is that waiting for your “golden years" because you want to reach 90% financial certainty must be balanced against the number of robust and zestful years you have left. You don’t want to work too many years past your healthspan if you can avoid it.

Digging Deeper: A more thorough tool for organizing your finances is a website called NewRetirement. The free account has a lot of options (although there are reminders to upgrade throughout the product). In addition the site also predicts the likelihood of how much money you’ll need throughout the rest of your life.

Here’s their “9 Tips for Estimating Retirement Expenses.”

To put your various accounts and records in order in preparation for a time you may become unable to manage your own finances, you can use an online platform – a “digital estate” – for your will, funeral wishes and more. I use everplans, but there are others. With everplans, for $112 AUD per year you can assign “deputies” to various records and designate whether they can access the records now or after you die. You can invite the deputies now and they can familiarize themselves with whatever records are accessible to them.

Tasks: Here’s a free blueprint of 80 important tasks that are worth doing while you have your full faculties. The more effort you put into “tidying up” your connections to the physical and digital worlds, the happier your loved ones will be when you are no longer around to explain things to them.

Summary:

Watch the above video

Run the Monte Carlo simulation.

Assess whether you will have enough money until you die. Whatever range of outcomes and statistical percentage the Monte Carlo simulation provides, if the number is not high enough add 7 years of work for each 10% increase. Decide on what percentage is enough for you to confidently retire.

Create a Retirement Plan, no matter how simple. Re-visit it every 6 months to review and revise.

Prepare a blueprint for when you are no longer able to pass on critical information regarding key aspects of your life — from access to your digital passwords to what kind of care you’d like for your beloved pets.

By addressing these key areas sooner rather than after it's too late, you can better navigate your post-work years with confidence, as well as enjoy a fulfilling retirement lifestyle.

It may seem like there is a lot to do for those currently unprepared, both in terms of tasks, as well as reflecting on your financial future. If you feel uncertain, you are not alone. As Robert Burns famously said, “The best-laid plans of mice and men often go awry.”

The key takeaway, after preparing all of the above, is to start answering this question, “What steps can I take to begin this new chapter of my life.”

Later,

Neill

Wow! Amazing and so timely! Many thanks, Neill!